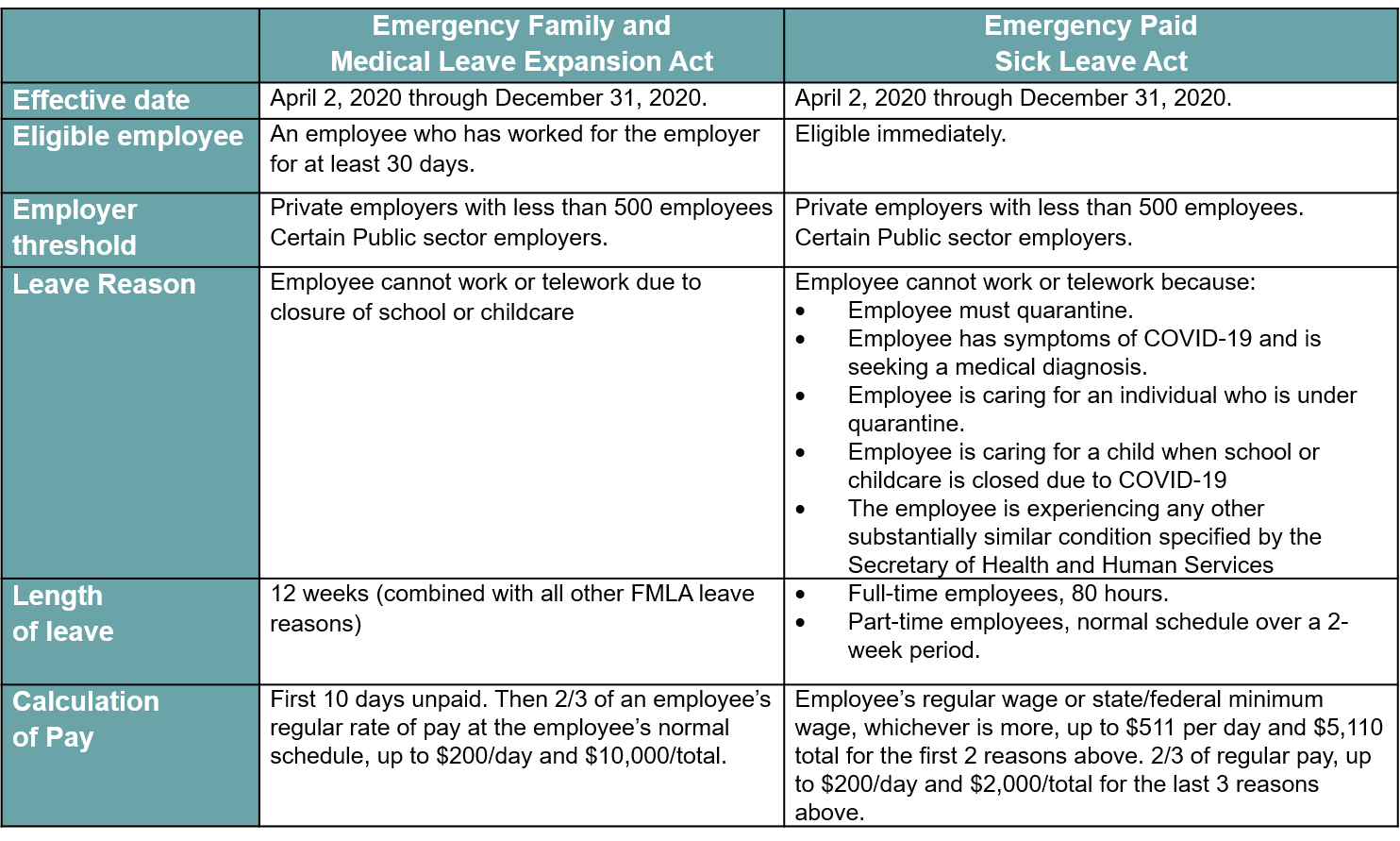

Over my career, I’ve considered whether the United States would ever offer paid family and medical or sick leave. In fact, just nine days ago I recently opined on the topic. And certainly, I never thought the federal government would introduce a paid leave bill, pass it, and get the president’s signature in under a week. But here we are, amidst a global pandemic crisis, and the United States Congress has come together to pass the Families First Coronavirus Response Act (“FFCRA”) which provides paid and unpaid leave from April 2, 2020, through December 31, 2020 in two ways:

- through amendments to the federal Family and Medical Leave Act (FMLA) via the Emergency Family and Medical Leave Act; and

- immediate paid sick leave through the Emergency Paid Sick Leave Act.

This law only applies to private employers with fewer than 500 U.S. employees and some public/government employers. The paid and unpaid leave provisions, which apply to the COVID-19 leave reasons listed below, provide job-protected leave as follows:

- Emergency Paid Sick Leave — immediate paid sick leave for any employee up to 80 hours (or a 2-week, pro-rata, period for part-time workers ) for:

- 100% of the employee’s pay for leave due to the employee’s own illness or quarantine (maximum of $511 per day or $5,110 in the aggregate); or

- 2/3 of the employee’s regular pay for leave to care for another individual who is sick or quarantined, or time needed due to a school or child care closure (maximum of $200 per day or $2000 in the aggregate)

- Emergency Family and Medical Leave Act — allows FMLA leave to care for a minor child due to a school or childcare closure due to COVID-19 precautions or quarantine. The first 10 days of leave are unpaid (but Emergency Paid Sick Leave or other employer-provided paid leave may be used). After that, the law provides paid leave at a rate of 2/3 of the employee’s regular rate of pay, up to $200 per day ($10,000 in the aggregate). Employees work for an employer with fewer than 500 employees and have been on that employer’s payroll for at least 30 days are eligible for this new FMLA leave reason.

An employee can take the Emergency Paid Sick Leave when the employee:

- must quarantine or self-isolate due to COVID-19

- obtains a medical diagnosis or care if the employee is experiencing the symptoms of COVID-19

- is caring for an individual who is self-isolating or in quarantine due to COVID-19

- must care for the child of such employee if the school or child care has been closed due to

COVID-19 - is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services.

An employee’s right to take paid sick leave ends after they return from leave. Tax credits are available for employers providing the required paid leave. The bill also has provisions to exclude employers with fewer than 50 employees and exclusions for health care providers and emergency responders. Review the full details of the new law can be found here.

Implications to current FMLA leave

The Emergency Family and Medical Leave Act adds the new COVID-19 related leave reasons to the existing 12-week time bank provided by the FMLA. That means that the employee is limited to 12 weeks for all leave reasons under the FMLA. If an employee has already used a portion of their FMLA entitlement, they would only be able to use the remainder for this leave reason.

Considerations for current disability and paid leave policies

Employers and carriers should review their existing disability plans and paid leave policies to understand what aspects of employee leave due to COVID-19 are covered under those policies and plans. It’s important to know whether FFCRA may offset a current disability or paid leave plan and how FFCRA leave dovetails with other sick leave or PTO. It is critical to understand and communicate what is covered and which policies pay what amount when an employee needs time off benefits during these quickly-changing times.

There is a wide swath of U.S. employees, self-employed, or independent contractors that are not covered by the FFCRA. Many larger employers are already offering similar leave or have temporarily shut down and are paying employees in the short term, if feasible. The FFCRA is considered “phase 2” of Congress’s COVID-19 relief measures for U.S. citizens. In the coming days, individuals and businesses can expect more relief from both the U.S., state, and local governments, beyond paid leave, possibly including unemployment benefits, debt relief or emergency access to credit or loans, and medical care and COVID-19 testing.