InsurTech Unplugged: GenAI Edition

In this edition of our InsurTech Unplugged series, Barry Duffy, VP Digital and Data, and Sarah Holdaway, VP Product ...

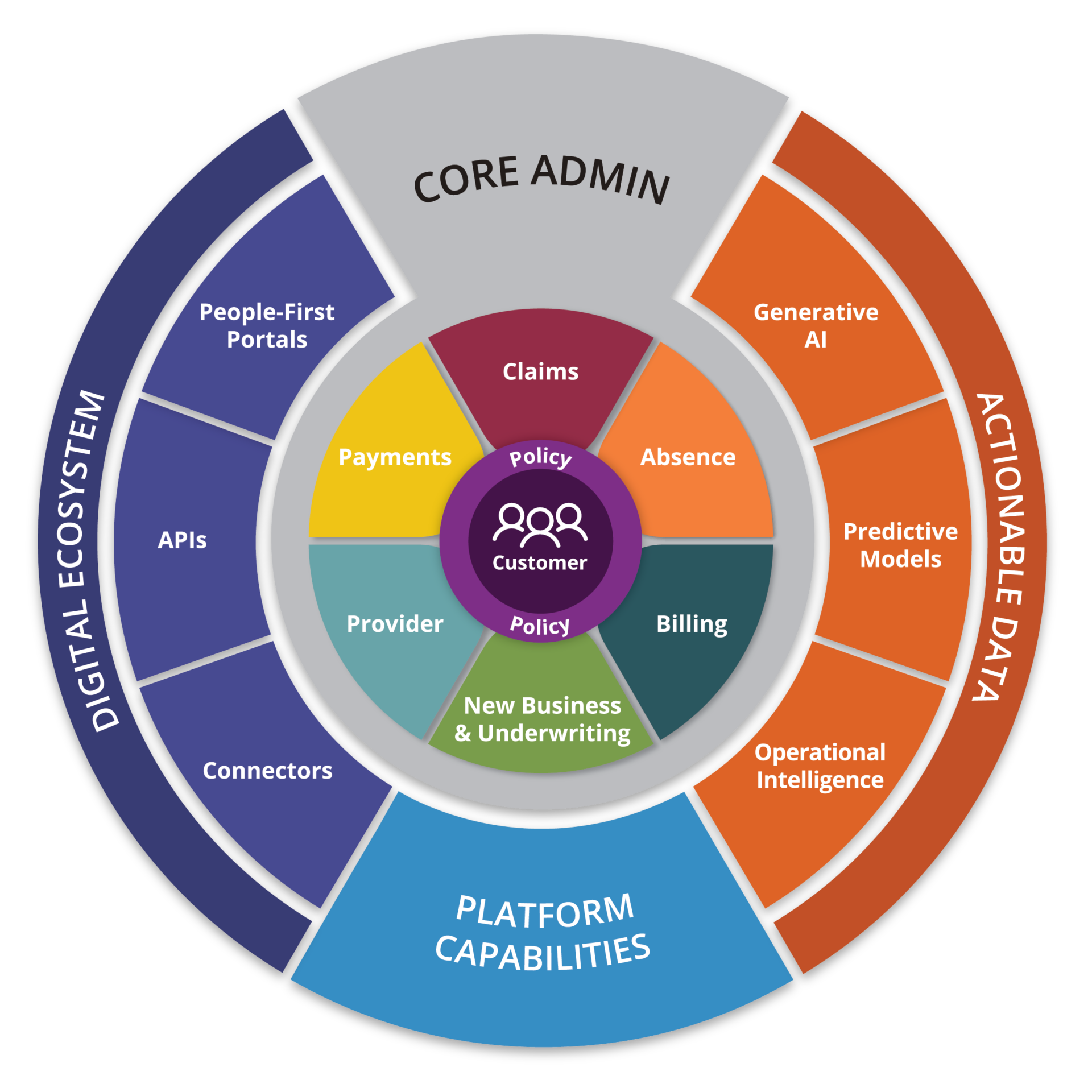

The FINEOS Platform provides a comprehensive end to end core solution for the Employee Benefits market and the Global Life, Accident and Health market. Critical to the solutions that underlie FINEOS AdminSuite, FINEOS Actionable Data, and FINEOS Digital Ecosystem, are the Platform Capabilities which provide a common set of capabilities that include workflow, rules engine, customer management, no-code/low-code configuration tools, a standardized API connection and the cloud environment powered by AWS.

At the heart of the FINEOS Platform is a cloud-native core-business insurance platform which is designed for mission critical use by both the smallest regional and largest multi-national carriers. FINEOS Platform is a suite of modern SaaS applications which can be used individually to meet urgent business needs and as an integrated core administration suite. Deployed to multi-tenant infrastructure, our architecture gives you the security, agility, and cost effectiveness you expect from a modern SaaS platform.

FINEOS Platform can scale to business needs and deliver digital service 24×7, for small businesses and very large enterprises. This level of business flexibility can only be delivered by utilizing cloud native technology such as:

Automation is a critical part of any digital insurance experience but only if the automation is simple to interact with, accurate and flexible to changing human and business circumstances. The FINEOS Platform provides the capabilities to use workflow, rules, AI tools and embedded best practices to create a dynamic, quick and satisfying user experience.

Insurance business value chains are often complex with multiple roles that have different types of interaction based on that person’s needs. By designing for the roles inherent in Employee Benefits/LA&H insurance, the FINEOS Platform supports each user with capabilities required to meet their needs and to provide a frictionless experience.

Embedded in the FINEOS Platform is a no-code capability that enables change without needing to write code. Business experts can redesign products and business processes, creatively responding to market changes. They can use our agile, code-free environment to:

FINEOS Platform also supports low code extensions to enable regional Market Solutions and customer specific requirements. A core system without the ability to extend through low code cannot deal with every possible change to the evolving insurance and employee benefits market.

The FINEOS Platform can be integrated and extended using our microservice extension architecture, allowing new or existing systems, calculators, business rules and other capabilities to be linked into the FINEOS Platform to change and extend core system behavior. This means that any change required by the business can be implemented in a timely way without dependence on the FINEOS organization.

The FINEOS Platform enables carriers to accelerate consumer digital service and business partnerships using public APIs. These APIs enable a digital version of the service capabilities offered to customers and partners through more traditional channels.

FINEOS Platform APIs are stateless, REST APIs with a JSON payload that are easy to consume from any platform. B2B use cases also include:

Security, availability, privacy and regulatory compliance are critical to any insurance core system in today’s environment. The FINEOS Platform is designed to support the most stringent security and regulatory requirements throughout the stack from data center security to application support for ERISA, FLMA and other regulated leave and accommodation requirements.