What do you think of when you hear the word ‘Knowledge’? You might think of Sir Francis Bacon and his famous quote from Meditationes Sacrae (1597): “ipsa scientia potestas est”, more commonly known these days as “Knowledge is Power”. Or you might reflect on your Philosophy 101 class and recall what Socrates said, “To know, is to know that you know nothing. That is the meaning of true knowledge”.

In our work today, we all know a person or persons who are our ‘go-to’ resource – why? Because they are ‘knowledgeable’. They are knowledgeable about the product, the process, the software systems, heck even how the coffee maker works, where the best place to buy lunch is and maybe even what the boss likes for treats.

But what happens when that knowledge disappears when your ‘go-to’ person retires? What do you do?

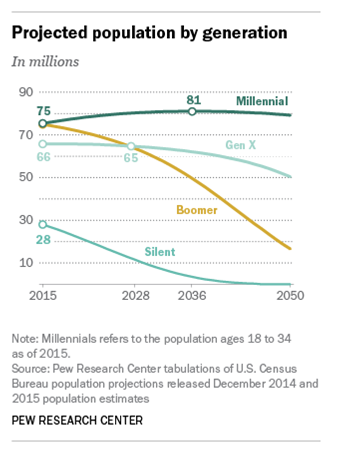

There’s a silent problem in the workforce that is slowly, steadily getting bigger day by day. We all know that the workforce in the United States, and in many other countries for that matter, is changing. The ‘Baby Boomers’ (born between 1946 and 1964) are no longer the largest living population in the Unites States according to the most recent U.S. Census Bureau’s population estimates.

That distinction goes to the ‘Millennials’ (born between 1981 and 1997).

‘Baby Boomer Brain Drain’ is how Rebecca Lindgren refers to it in her article: ‘The Looming Baby Boomer Brain Drain‘. In the article, Ms. Lindgren provides statistics she gathers on this ‘Brain Drain’ and some are telling:

- By 2029, all ‘Baby Boomers’ will be age 65 or over

- ‘Baby Boomers’ represent 31% of the U.S. workforce

- 56% of leadership positions are held by ‘Baby Boomers’

- 4 million companies, which is 66% of all businesses with employees, are owned by ‘Baby Boomers’

You might be asking yourself, “Thanks Joe for all the quotes and stats, but why is this important to me?” It is important because, as Ms. Lindgren points out, ‘Knowledge-Intensive Industries’ will experience the most ‘acute’ brain drain, and insurance, especially claims management within insurance, is highly ‘knowledge-intensive’.

Let’s face it, insurance careers, especially claims management, are not exciting or ‘sexy’ to the ‘Millennials’ – they are not flocking to replace those that are leaving. Even if an insurer is able to entice a ‘Millennial’ to come work for them, keeping them might be even harder given that most ‘Millennials’ do not desire a ‘9 to 5’ career if given a choice.

The late writer, educator, consultant and professor, Peter Drucker once said, “Knowledge has to be improved, challenged, and increased constantly, or it vanishes”. So, if the ‘knowledge’ is leaving with the ‘Baby Boomers’ what can be done? How will knowledge be improved, challenged and increased?

Luckily, there are ways in which technology can help. What used to be stored in the ‘go-to’ person’s brain can now be part of the software solution. Some of the many rules, procedures, calculations and assessments the knowledgeable make can be codified and built into business case rules embodied within systems such as FINEOS Claims. Calculations that were once done by hand and then in spreadsheets are now done in the software solution, automated tasks are part of robust workflow management to keep the claims examiner on track, automated communications via multi-channel distribution methods provide the claimants with up to date information so that a call or email is not necessary. Even the coffee maker just needs a Keurig cup, no need to remember how many scoops to add, thank God.

This isn’t about de-skilling and automating the life out of the claims handlers’ jobs; it’s about ensuring good practice is available to all, that a good system supports, advises and guides where necessary and frees the claims handler to focus on the ‘art’ of their job. Technology can help with the ‘science’ of claims management, but the ‘art’ still lies with the ‘go-to’ people in the industry and that ‘knowledge’ needs to be harvested as much as possible before it ‘vanishes’. Are you prepared?