Rob Say, Professional Services Consultant, FINEOS

I recently attended an insurance technology conference (TINTech 2013) and was involved in several discussions on claims management and future developments in the London Market. Something nagged at me during the day and I realised that we didn’t actually step back and look at why the London Market exists and why it has such longevity – both of which have critical implications for the future.

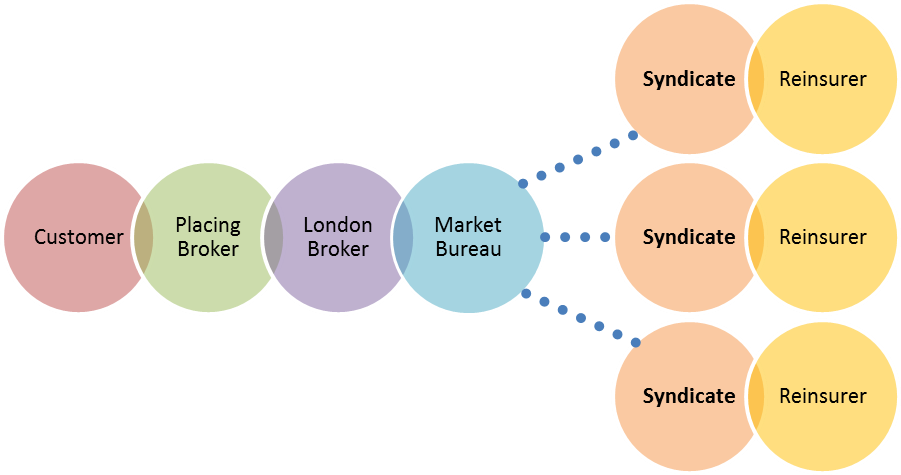

A syndicated insurance market is a complex thing. I’ll borrow and expand one of the presentation diagrams – even at this simplified top level there are a large number of entities involved for each risk.

It is fundamentally a less efficient operating model for placing insurance and handling claims than an equivalent full service provider. When we’re discussing claims management this begs the question: Why hasn’t it been out-competed? Why does the syndicated insurance model persist?

The efficiency is the key point – if the model is less efficient, then there must be a unique offering. To my mind there are three offers in play right now:

- Capacity – the syndicated market can simply cover enormous volumes of risk(†)

- High value coverage – syndicated coverage means larger risks can be more easily accepted

- Complex/specialist coverage – specialist risks require specialist underwriters and claims response and this need grows with the size and complexity of the risk

It’s this last one that interests me. As a specific risk is better understood, modelled and that information propagated, the coverage of that risk will inevitably become a commodity.

300 years ago, at what is arguably the start of large scale global commerce, a group of entrepreneurs started insuring Marine risks; it was cutting edge, it was risky and it was profitable. Move forward to the present day and a lot of the objective risks of Marine transport are well understood (and mitigated), the volumes are much higher and there’s far more competition. It stands to reason that elements of Marine risk coverage are a candidate for commoditisation.

The London Market thrives on non-commodity risk coverage – so new risk specialisms will need to continue to be developed by the Syndicates.

Of course, it’s not just a case of mastering specialist & complex risks, you still need to deliver on the promise. If we accept that the operations model for syndicated insurance is more complex than the competition, then the business case for addressing efficiency in placement and claims processing is compelling. I’ll return to that topic in a later post.

† this is actually an efficiency gain associated with securing capital but that’s resources, not operations