By Jonathan Boylan, Chief Technology Officer, FINEOS

As the number of sophisticated data analytic technology products increases, it is becoming apparent that they are a wasted investment and destined to failure unless the core data itself is rich, reliable and reachable.

Rather than invest in analytical products on a promise of visually very impressive outputs, insurers must first look at their core internal data model and simply ask: Is this right?

Good claims data presents an incredible opportunity for insurers to gain a competitive edge in the market.

However, in the new world of analytic tools, many insurance organisations that have been successfully leveraging their claims data, have gained real business benefits. This is experienced across three main areas:

- Increased efficiencies in process

- Reductions in the overall cost of losses

- Increased levels of customer satisfaction

Many Insurers cannot understand why, after investing in expensive high tech data analytic applications, they are not producing the results they had been originally promised.

The reason is many traditional claims systems have narrow data sets and suffer data quality problems through prolonged system and human error. Therefore, the most sophisticated analytical solution will be rendered useless without rich quality data feeding into it.

This issue will become more apparent with the many new reporting requirements under Solvency II. Spending budget on reporting tools will not produce what is required under the Directive unless the core data is comprehensive and can be trusted. This must be addressed first.

Moreover, the source of data is no longer from the traditional channels. Insurers must to be able to integrate the external flow of information, such as the Internet and industry databases, into the core claims system.

As these data sources are relatively new, many existing claim systems simply cannot do this efficiently.

FINEOS and leading Insurance Analyst firm, Novarica, recently presented a webinar entitled “Leveraging Claims Data to Boost Performance”. The research presented by Novarica shows that firms in the U.S. who have successfully leveraged their claims data, have been rewarded with handsome monetary dividends.

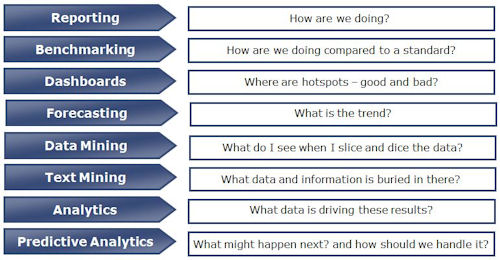

So what can a rich claims data source do? Using historical, current and predictive views of business operations, insurance organisations can make informed decisions and manage performance.

FINEOS Claims, a modern web based multi-line claims system for Life and General Insurance, contains a comprehensive data model that ensures incoming data is authentic, validated and protected from human error. FINEOS Claims also encompasses reporting and analytical tools for managers to make fact based decisions. To cater for specialist third party data analytical tools, FINEOS can easily provide the data from the core data model.

A modern claims system is key to leveraging the benefits from good claims data. Although the analytical tools will steal the limelight, the real success factor here is the quality, accessibility and availability of the core claims data.