This is a time of accelerating change for nearly every industry, with disruptors entering established markets and turning them on their heads. We have seen this happening in many industries outside insurance and yes, today we are witnessing insurance carriers wanting to become more and more involved. Today’s customer wants to be serviced faster and more efficiently than ever before. They are used to great experiences in other industries and they are demanding it from their insurance providers. This trend is only in its infancy.

Who or what is coming along that is going to totally change the insurance industry? Everywhere you look, leading technology companies are making big moves and extending into industries we might not have expected just a few short years ago. For our industry, not historically known for being leading edge when it comes to technology, this presents a very real threat.

In order to survive and thrive in Life, Accident and Health, insurers with legacy core admin systems still in place need to accept the following realities:

- Inflexible, disconnected, and expensive core systems must get out of your way.

- No one in Life, Accident & Health is so unique as to require bespoke core systems (read more here).

- Most carriers don’t want mega-IT projects – they want continuous delivery (watch video here).

- User Interface, intelligent automation, and connectivity are KEY success factors for a digital business. (read more here)

- Business transformation and technology innovation go hand in hand. (read more here)

I’ve linked out to blogs, videos, and articles in numbers 2 – 5 above, but I want to focus on number 1: Inflexible, disconnected, and expensive core systems must get out of your way.

A study by insurance industry analyst firm, Celent, confirmed what we all know – that insurers are still relying on mainframe-based core software systems. The report states that insurers often talk about their primary system that was installed 20, 30, 40, and even close to 50 years ago! In the computing world, where the speed of technology doubles every 18 months, the thought of a software system originating from fifty years ago is fairly special, but also a bit daunting. Those of us who know and love the insurance software industry have come to appreciate this stark reality.

Tom Scales, co-author of Celent’s report, Mainframe-Based Core Insurance Systems – On the Road to Oblivion?, explains that insurers didn’t mean to let their systems get so old. “It’s just that the software was paid for and running fine and there wasn’t a compelling reason to replace it. Their attention was focused instead on creating new products, marketing and distribution techniques that could grow the business. It’s like a car you drive to work every day,” Scales says. “It’s just your commuting car, it’s not very exciting, but it runs, the maintenance is low and the gas mileage is good. Unless you really need one, why would you go out and buy a new car?”

So why would you go out and buy a new car?

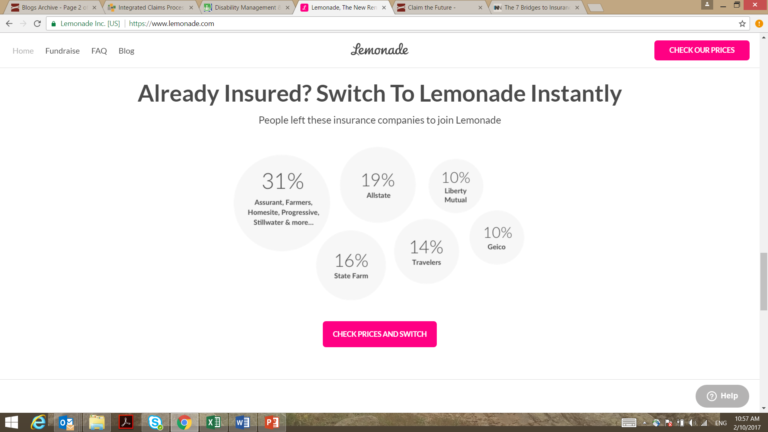

- Disruptive competition – from new entrants and existing insurers

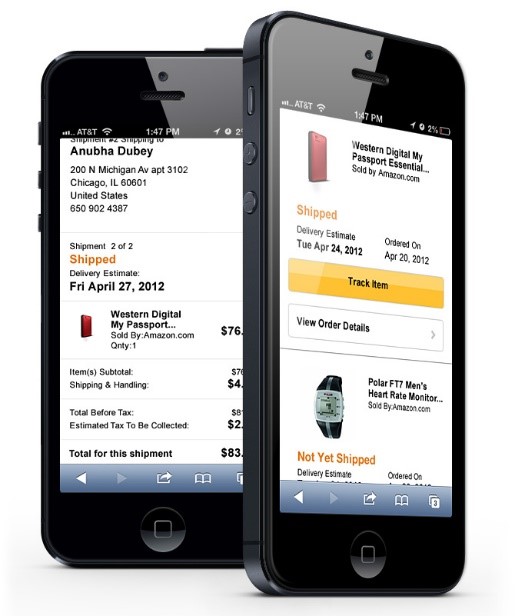

2. Unprecedented customer expectations of digital service and being “always-on”

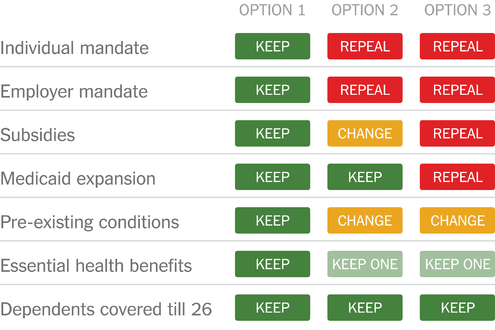

3. Regulation – privacy, ACA uncertainty, paid leave

4. Technology – the Internet of Things (Wearables), Analytics, Cloud, Mobile

5. New business models – changing products, services, distribution, payments

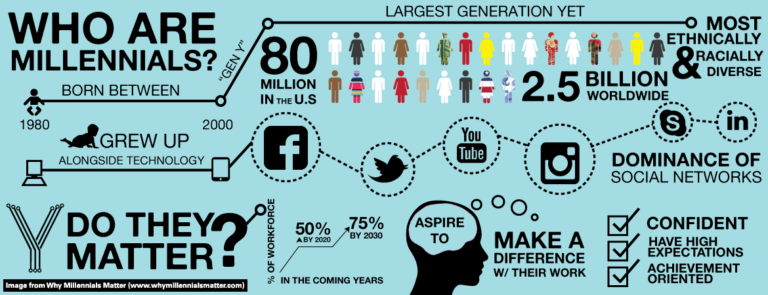

6. Changing demographics – people living longer, millennials are majority of workforce

Dependence on legacy systems is hindering progress and making survival a real question for many Life, Accident and Health insurers. The opportunities presented by all of the change listed above are almost endless, but being shackled to legacy core systems makes an insurer’s ability to grow and extend nearly impossible.

To be fair, many of the points above have been addressed by insurers, who have at least transformed their front-ends to meet customer expectations and appear modern. But these more modern front-end software systems are usually still integrated with the legacy core back-office systems. The tighter the level of integration achieved between the front-end and the legacy core systems, the more automation and straight-through processing that is possible. However, attaining tight integration between front-end and core legacy systems is expensive to achieve, and that expense goes up in multiples in the longer term when you have to invest in continuously supporting and maintaining the integration code between these systems. The front-end systems tend to change more frequently than the back back-end, but both undergo change, which very often means three points of software system change (the front-end, the back- end, and the integration) to implement a single business change. The total cost of ownership can become overwhelming and lead to compromises in scope, limitations for the business, and an overall reduction in return on investment.

We at FINEOS believe that for Life, Accident and Health insurers to survive and thrive in the future, they simply must move outdated legacy core systems out of their way. It will be the only way to stay agile and competitive in the digital world. We would love to talk further with you about your own systems and processes and continue the conversation. Please contact us directly at info@FINEOS.com.