As 2020 wraps up, the leave of absence community waited with baited breath to see if Congress would extend the mandatory paid leave provisions of the Families First Coronavirus Response Act (“FFCRA”), implemented last March and set to expire December 31, 2020. The FFCRA had expanded the federal Family and Medical Leave Act (FMLA) via the Emergency Family and Medical Leave Act and provided paid sick leave through the Emergency Paid Sick Leave Act.

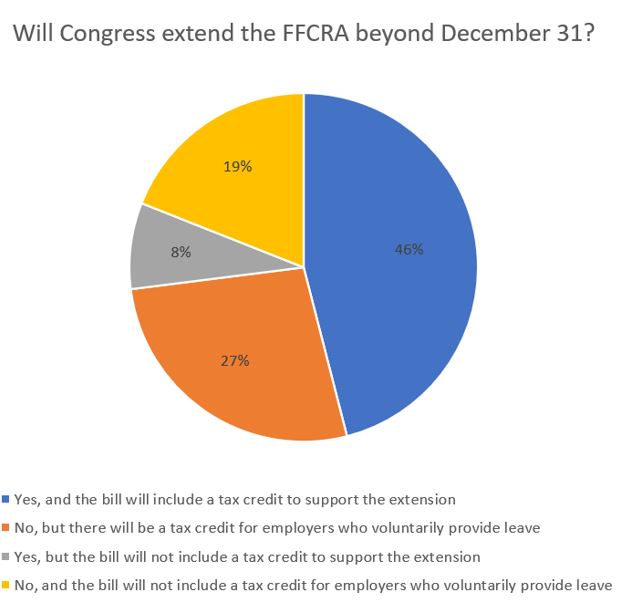

An informal industry poll on Megan Holstein’s LinkedIn page predicted that the FFCRA would be extended, with a tax credit to support it:

Twenty-seven percent of the polltakers can pat their legislative prediction skills on the back. Reports out of Congress, including a recently released draft of the bill, indicate that while the legislation extends the tax credit for employers who opt to provide employee paid sick leave or emergency paid Family and Medical leave through March 31, 2021, it does not extend the mandatory leave provisions under the FFCRA. In short, employers are no longer required to provide the expanded and paid leave, but if they do, they can take a tax credit.

We await final signature by the President before the full pandemic relief package is finalized.